Direct Payouts & Taxes

Does Houfy integrate with PayPal

Where can I tell if I signed up for Square or Stripe?

To view if you are connected to stripe or square on Houfy go to:

- Log in

- Manage Listings

- Select Connected Payments on the left menu

I set up Stripe and still can't set my pricing for Houfy to collect?

Please follow these instructions to connect to Stripe:

- Log in to Houfy

- Go to Connected Payments

- Select Stripe and connect

How to view my earnings report on Houfy?

Please follow the steps below to view my earnings report on Houfy

- Go to HoufyPay from the right menu

- Scroll down to dropdown named Transactions type and select Payments

- Click Export to CSV

- You can also exports Refunds made via Houfy

How to set no tax for long term reservations?

Link Different Stripe Accounts for Different Properties on Houfy

If you manage multiple properties on Houfy and want to link each property to a different Stripe account for payouts, follow these simple steps to set up and organize your accounts effectively.

You can also view this wonderful helpful video created by one of our hosts for a visual walkthrough: Watch on YouTube.

Step-by-Step Guide: Linking Stripe Accounts to Properties

1. Log in to Your Houfy Account

- Go to the Houfy homepage and log in using your credentials.

- Navigate to Manage Listings from the dashboard.

2. Access the Connected Payments Section

- Click on Connected Payments.

Here, you’ll see all your payout/payment methods and payout/payment routing rules.

3. Create a Stripe Account for Each Property

- For each property, set up a unique Stripe account.

Visit Stripe to create a new account, ensuring that you use distinct details for each property. - Tip: Customize the Statement Descriptor in Stripe to reflect the property name. This ensures clarity on guest credit card statements (e.g., "Camp Coral").

4. Link the Stripe Account to the Property on Houfy

- In Houfy’s Connected Payments section:Select Add Payment Method.

Choose Stripe as your payment processor.

Log in to Stripe using the credentials of the specific Stripe account for the property.

Once logged in, click Connect to finalize the connection.

5. Set Up Routing Rules

- After linking the Stripe account, add a routing rule to map the correct property:Identify the property without a routing rule in the Connected Payments list.

Click Add Routing Rule.

Select the property from the dropdown and ensure the correct Stripe account is linked.

6. Verify and Save

- Double-check the connection between the property and its Stripe account.

- Save your routing rule. You’re now set up to receive payouts for this property through its designated Stripe account!

How to Activate Instant Book on Houfy?

Instant Book allows guests to reserve your listing immediately, without waiting for manual approval. Instant Book is now available to all Houfy users who meet certain requirements:

- Connected Payment Processor: You must have an active payment processor connected to your Houfy account.

- Up-to-date Pricing and Calendar: Your calendar must be accurately maintained through either an integrated PMS/channel manager or via iCal synchronization.

What is Instant Book?

Instant Book streamlines your booking process by automatically confirming and collecting payment on your guest's reservations, with no additional steps required from you.

Who can use Instant Book right now?

- PMS/Channel Manager Users:

Users connected via an integrated PMS or Channel Manager (e.g., OwnerRez). - Non-PMS/Channel Manager Users:

Users managing listings manually, provided they maintain accurate calendar synchronization through iCal.

How to Enable Instant Book

For PMS/Channel Manager Users:

- Confirm Your Settings:

Ensure Instant Book settings, calendar availability, and pricing are correctly configured in your PMS or Channel Manager (such as OwnerRez). Houfy automatically syncs these settings. - Activate Instant Book on Houfy:

Log in to your Houfy account.

Navigate to Manage Listings and select the relevant listing.

Go to the Calendar tab.

Scroll down to the Allow Instant Book setting.

Select Yes to activate Instant Book.

For Non-PMS/Channel Manager Users (iCal sync):

- Confirm Your Settings:

Ensure your pricing and calendar availability are consistently updated through iCal synchronization. - Activate Instant Book on Houfy:

- Log in to your Houfy account.

- Navigate to Manage Listings and select the relevant listing.

- Go to the Calendar tab.

- Scroll down to the Allow Instant Book setting.

- Select Yes to activate Instant Book.

Tip: If you don’t see the “Allow Instant Book” option, it may not be enabled for your account yet. Stay tuned for updates.

Important Notes:

- Feature in Progress:

This is a new feature and is being rolled out gradually. - Payment Processor Required:

Instant Book requires an active payment processor connected to your Houfy account. - Availability and Accuracy:

Instant Book relies on accurate pricing and availability. Ensure your calendar and pricing remain consistently updated to avoid double bookings or cancellations. - Support for More Partners:

We continue to expand integrations with additional PMS and Channel Managers to enhance your Instant Book experience.

For assistance or if the "Allow Instant Book" option isn't visible, verify your account settings or contact Houfy Support directly.

Houfy and accepting direct payments by connecting to Stripe or Square

We have connected the payments processing companies Stripe and Square to Houfy for you to receive direct deposits & payments from your guests. This will only work if your listing is completed and verified by us.

The process to add this service is extremely simple:

- Please Log in

- Menu

- Manage Listings

- Payments & Payouts

Wonderful helpful video made by one of our hosts on how to connect to stripe:

Square: You can sign up for Square directly here through this referal link if you are in the U.S. For Stripe go to Manage Listings > Connected Payments.

Pricing?

What are the countries that support Square?

Card payment acceptance with the Square app is currently available in the US, Canada, Japan, Australia, and the United Kingdom. Square currently doesn’t support payment card processing outside of these countries or in U.S. territories such as Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and Northern Mariana Islands.

Stripe: Pricing?

What are the countries that support Stripe?

Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Japan, Luxembourg, Netherlands, New Zealand, Norway, Singapore, Spain, Sweden, Switzerland, United Kingdom, United States, Italy, Portugal

Sample of booking process with payment:

FAQ: How do payments work with Houfy?

If you would like your Houfy listing to be online bookable, just connect a Stripe or Square account to your listing.

What does "connecting" a Stripe or Square account do?

It allows travelers to enter a credit card at checkout like how they pay on Airbnb and Vrbo. The funds then land in your bank account.

What if I don't want to use Stripe or Square?

There is no requirement to use either one. Just have guests pay however you like outside of Houfy. For example: bank transfer, check, Business PayPal, cash, etc. Payment methods are up to you.

Will Houfy hold my guest payments until after check-in?

No. Houfy doesn't handle money. Just connect a Stripe or Square account to your Houfy listing. Travelers can then enter a credit card during checkout. Guest payments are deposited directly into your bank account, as they never pass through Houfy.

What are the pros and cons of using Stripe or Square?

Read this quick and easy Square and Stripe comparison. Be sure to check with Stripe and Square directly for the latest updates and any specific questions about your account.

How do I connect my Stripe or Square account to my Houfy listing?

Log in to Houfy > Click on Profile Pic > Manage Listings > Connected Payments. It takes a few seconds to connect. Don't forget to do a test booking.

What does it mean to be online bookable?

It means the traveler can book and enter credit card at checkout, just like on Airbnb or Vrbo.

Does Houfy have instant book or will I be able to vet travelers?

There is NO "instant book" on Houfy, and you can always talk to travelers first. Once a traveler enters credit card info, you'll receive a PENDING DIRECT BOOKING to accept/decline the booking payment.

Can you explain what Stripe and Square are? I have never heard of them.

They are 3rd-party payment processors, similar to using Business PayPal to accept credit card payments.

Do I have to have a Stripe or Square account to list on Houfy?

No. There is NO REQUIREMENT to use either one. You can have all guests pay in cash if you like.

Can any other payment processors like PayPal connect to Houfy?

Not at this time. Square and Stripe are the current options. You can still use your own payment methods outside of Houfy.

How much do Stripe and Square cost?

Around the same 3% you pay to Vrbo and Airbnb. The difference is you receive payment right away. Read this easy Stripe and Square comparison and be sure to visit their websites directly for accurate information and more questions.

Can a guest use a different credit card to pay a remaining balance?

Do guests need to sign up for Stripe or Square in order to pay with credit card?

No. If your Houfy listing is Stripe or Square connected, guests just enter their credit card during checkout. It's no different than booking a property on other platforms.

No. If your listing has Stripe or Square connected, then travelers just enter their credit card during checkout. It's no different than booking a property on other platforms.

View Square Credit Card Transactions on Square Dashboard

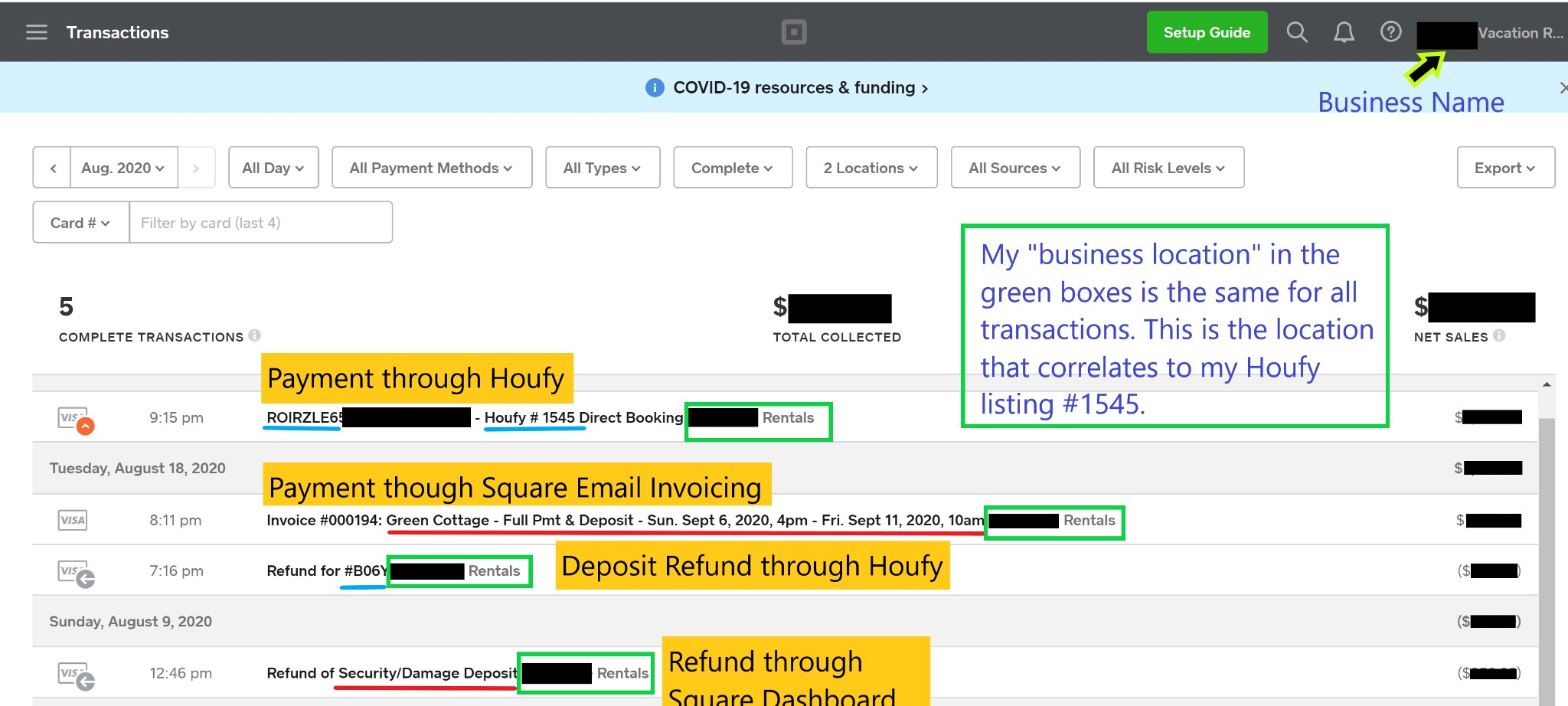

Whether you are sending email invoices through Square or receiving payment through Houfy using the Square's eCommerce integration, all transactions will be visible from your Square account dashboard. i.e. Sign into your Square account to see the transactions.

Below are some screen shots showing transactions recorded in the month of August from my Square account. I have 2 business locations, but only have transactions for one of them in August. My correlating Houfy listing is #1545. I don't have any other eCommerce integrations other than Houfy.

Display your Square Transactions

On your Square Dashboard Home screen, the left panel will display several icons. Choose the "Transactions" icon. You can then choose filters to limit what you display in the transaction report.

The screen shot below shows 4 of the 5 transactions that I have in Square for the month of August. I've redacted the dollar values and names that I didn't want to share here. Note that the colorful additions are mine to help explain what's shown.

On the upper right of this screen, my business name is listed. Although my filters allow "2 locations" (the 2 locations I've created where each represents a specific rental property), I didn't have any transactions for one of my properties. The information in the green box of each transaction holds my location name. This location name is the one I assigned to my Houfy #1545 property.

Square Invoice Payment Compared to Houfy Payment

In this example report above, the first 2 transactions are payments I received and the last 2 transactions are refunds I issued. In each group, the first is via the Houfy eCommerce integration and the second is related to email invoicing using the Square interface directly.

On the Houfy payment, the "ROIRZ..." value (underlined in blue).is the reservation code as generated and stored with this reservation in Houfy. I can also see that this payment is for my Houfy #1545 listing. But to understand for which reservation these payments and refunds correlate, I need to click on that transaction to get additional details as recorded by Houfy.

For my email invoiced payment, the transaction includes the invoice number that I can look up on "Invoices". Plus it also includes the full subject line of my email invoice. I've underlined that value in red.

On the Houfy refund, the report description indicates it's a refund but no real details. To understand for which reservation this refund correlates, I have to click on the transaction to see the details.

On the refund I issued via Square dashboard, the "item" from the invoice that I'm refunding is listed (underlined in red). But again, it's not evident for which invoice/guest this refund is being issued and I'll have to open the details by clicking this transaction.

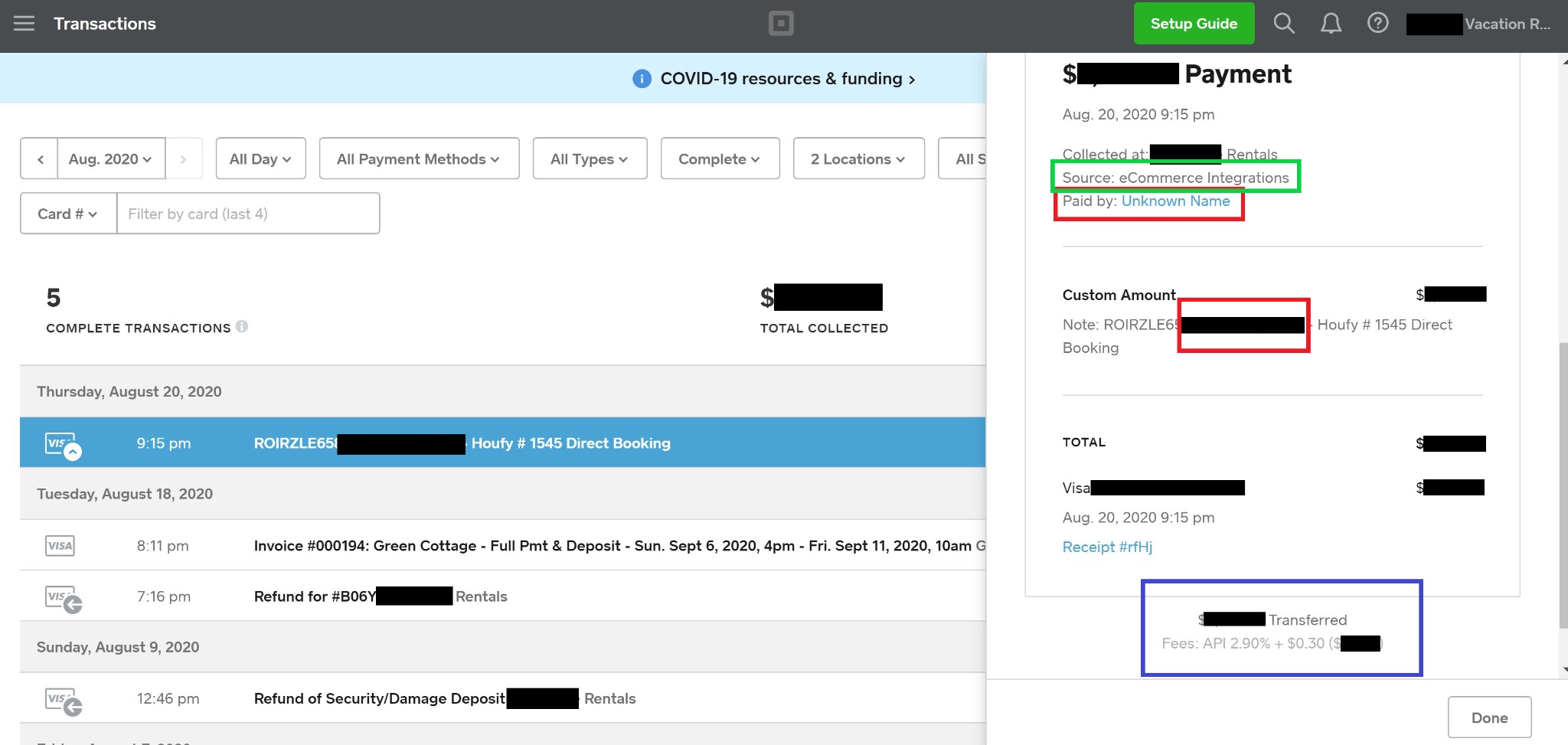

See Transaction Details

Let's look at the Houfy payment transaction. I just clicked on the transaction and a detail window opens on the right allowing me to see most of the transaction report at the same time. I know which transaction I'm looking at because the report row that I selected is now shown as white lettering on the blue background.

The green box area shows that the source of this transaction is "eCommerce Integrations" (i.e. Houfy). My Square email invoice transaction shows "invoices" as the source.

The red boxes show "Paid by: Unknown Name" on the Houfy transaction whereas on my Square email invoice transaction, my guest's name is listed.

The Houfy guest name does show up in the "Custom Amount" section in the red box area. This section also shows the total amount from Houfy. There is no breakdown showing rental charge, any fees and taxes. I'd have to go back to Houfy and look at my reservation record to see those details.

The Square email invoice detail includes a copy of the invoice with the specifics of the transaction. You'll know what portion of the collected amount is rent or taxes or fees.

The refund transactions also specify the source of the refund - either eCommerce Integrations or Invoices.. Both also include records of the original invoice/payment from which the refund is being issued. Again, the Square original invoice is detailed but the Houfy invoice is just a total originally charged.

At the bottom of this detail section (blue box) is the total transferred to my bank account and the value of the fee charged me and deducted from the guest's payment.

The Square fee is the same whether using Square Email Invoicing or eCommerce Integration with Houfy.

Can I connect other payment processors for payments besides Stripe and Square?

In order to connect to Houfy, you must use one of the integrated processor oprtions: at this time Stripe and Square. You can still choose to use other payment methods to invoice your guests directly.

Can my guests still send me an inquiry?

Yes. If your payment method is not connected then travelers will send an inquiry and you will invoice directly. From the inquiry you can use the "mark as confirmed" button. This will block the dates on your calendar while you arrange payment directly with the guest. Here is information of what to expect for your first inquiry or online booking request.

How do I add my own payment method?

Just complete the payment information section on your listing to let travelers know what kind of payments you accept. Check off any credit cards and add any additional information in the payment policies box.

What are the pros and cons of Stripe vs. Square?

Here is a comparison guide of Stripe and Square. Once you sign up for a free Stripe or Square account, you need to connect it to Houfy so travelers can book your property online.

If you have more questions, please join our facebook member group

Understanding Credit Card Costs

In order to recover your credit card costs in your rental pricing, you need to understand the true cost of accepting credit cards. In this story, I'll explain how to determine the true cost of the credit card fee relative to your rental rate and how to set your rental rate at a value that will allow you to receive the rental take-rate you desire to cover these credit card costs.

Square Pricing Structure

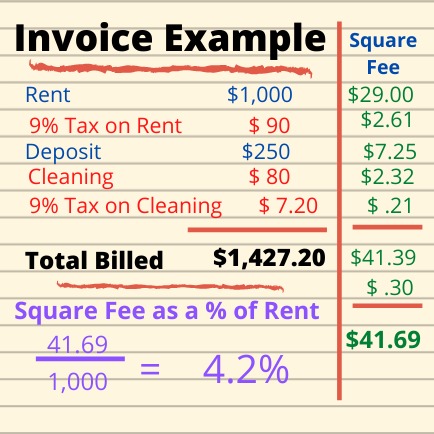

Since I'm familiar with Square Email Invoice Pricing, I will use that service in my following calculation examples.

Square charges a fee of 2.9% on the invoice total plus 30 cents per invoice (as of October 2019). This is the cost for either email invoice or taking payments through Houfy using Square integration.

The cost to you can vary by the number of invoices you accept payment on:

- One invoice for all = 2.9% of invoice + 30 cents

- Two invoices for all = 2.9% of both invoices + 60 cents

- Three invoices for all = 2.9% of all invoices + 90 cents

Net: The more invoices issued and then paid through Square, means a slightly higher cost by fractions of a dollar to you.

Note: If you issue an invoice through Square, but payment is received outside of Square, you can mark the invoice paid with a notation of how that payment was made. Square will not charge you a fee on the invoice if they did not actually collect the payment.

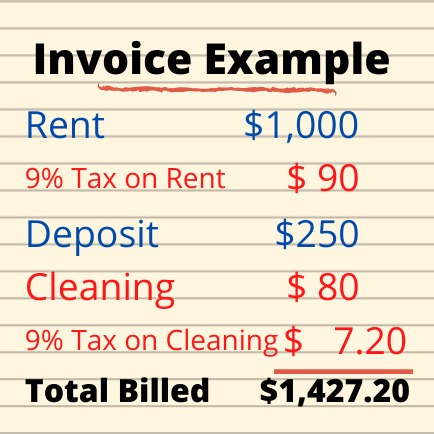

What's on Your Invoice?

The invoice to your guest includes not only your rental fee, which could vary by the rental period, but also additional static or variable fees you charge (cleaning fee, additional guest fees, security/damage deposit etc), plus the taxes you collect for all taxing authorities on all the taxable items on your invoice (local, state, tourist, etc.).

Consider that not all these charges are for money going into your pocket. The cleaning fee may be the exact charge your cleaner charges. Many of the items on the invoice are taxable in most jurisdictions.

Net: You're paying the 2.9% Credit Card Fee on everything on your invoice including charges that aren't yours.

Let's Calculate the True Cost

This is where Algebra education will come in handy! Let me define some values and variables and develop formulas to calculate the true credit card cost.

Let's set the variable X to be the rental fee you plan to charge. This could include variable fees that you charge such as extra guest fee. The thing to understand about X is that this is money coming to you. This variable X is taxable.

Let's say that you require a $250 deposit for every reservation. It's a static cost that you will be charging. Per your tax jurisdiction, this is NOT a taxable item. This is also money going to you with the intention of refunding to the guest after their stay.

You also collect an $80 cleaning fee per reservation. This fee is taxable and you are required to collect the tax on this fee.

In this example, I will keep the taxing requirement easy. Let's say the tax rate is 9%. This rate will be written as .09 in our mathematical formulas.

The Square credit card fee is 2.9% and will be expressed as .029 in our formulas.

These are the items that will be included on the invoice to the guest:

Rental fee + tax rate on Rental fee + deposit + Cleaning Fee + tax on Cleaning Fee

When calculating your specific formula, it might be easiest to start as I've shown above, using words to list all items that will be included in the invoice.

Using Algebra, the formula looks like this (remember X is the variable associated with your rental fee from this guest.)

Invoice to guest = (X + .09X) + 250 + (80 + .09(80) )

Invoice to guest = 1.09X + 337.20

For a rental rate of $1000, this invoice to guest would be $1,427.20

The total is then charged 2.9% by Square, shown in the next formula, where I've also grouped values from our invoice values above and also added the 30 cents that Square collects per invoice payment received.

Square Fee = .029 * ( 1.09X + 337.20) + .30

Using Algebra, let's adjust this formula so it's easier to work with:

Square Fee = .03161X + 9.78 + .30

Square Fee = .03161X + 10.08

This Square Fee formula takes into account the 9% tax on the rental fee as well. ex. As X, the rental fee increases, X is still multiplied by 1.09 (rent + tax) and the .029 Square fee.

Let's Plug in Some Numbers

Let's say the rental fee to our guests is $1000. Using our established formulas that include deposit and cleaning fee:

Square Fee = (.03161 * 1000) + 10.08

Square Fee = 31.61 + 10.08

Square Fee = $41.69

Summary on $1000 rental rate:

Invoice to guest - $1,427.20

Tax on rental rate paid by guest: $90.00

Square Fee - $41.69

Your true take rate on the rental is actually $1000 - $41.69 = $958.31

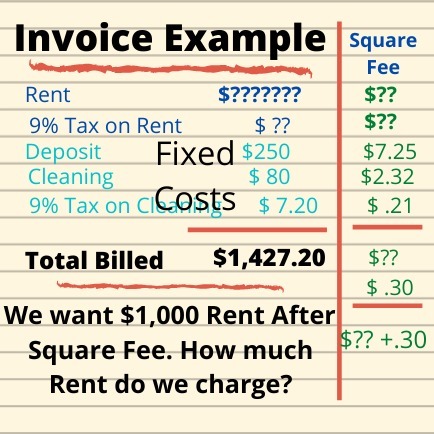

Adjusting Your Rental Fee for Credit Card Fee Recovery

If you'd like to adjust your rental rate to cover this credit card fee, increasing the fee by $41.69 will not do that! This is because all prices on your invoice will be charged the same 2.9% fee. This would mean you would pay 2.9% fee on the $41.69 too, thereby collecting less than $41.69 from Square!

On top of that, when you charge a higher rental fee to recover this Square processing fee, you'll also have to collect more tax on the rental fee increasing the Square processing fee further than just the rental fee increase.

Let's figure out Rental Fee that Covers the Square Charge

If we didn't have fees, we've already determined that our invoice to guest including deposit, cleaning and taxes would be $1,427.20. So let's work towards receiving that amount....or really an amount close to this number. Keep reading to understand this....

We've already determined that our fixed costs including tax on cleaning fee totals $337.20. We also know that the Square fee is .029 times the total of rent + tax and these fixed costs.

Our formula that takes into account the Square Fee should result in a total received by us as $1,427.20. This total assumes we're collecting $90 in rental tax. But we know that with a higher rent, our tax will also be higher. We'll have to receive not only the $90 on the first $1,000 of rent collected, we need to receive 9% tax on the new rent amount over this first $1,000. Therefore, our new invoice must not only total $1427.20, but also include the 9% tax on the new rent over $1,000.

Here's our new formula and the steps to solve for New Rent:

Taxable New Rent + Fixed Costs - Square Fee = $1,427.20 + .09 (New Rent - $1,000)

1.09(New Rent) + $337.20 - [ .029 ( 1.09(New Rent) + 337.20) + .30 ] = $1,427.20 + .09 (New Rent) - $90

1.09(New Rent) + $337.20 - .03161(New Rent) - .029(337.20) - .30 = $1,427.20 + .09 (New Rent) - $90

1.05839(New Rent) + $327.42 - .30 = $1,427.20 - $90 + .09 (New Rent)

1.05839(New Rent) + 327.12 = $1,337.20 + .09 (New Rent)

1.05839(New Rent) - .09 (New Rent) = $1,010.08

.09639 (New Rent) = $1,010.08

New Rent = $1,010.08 / 0.96839

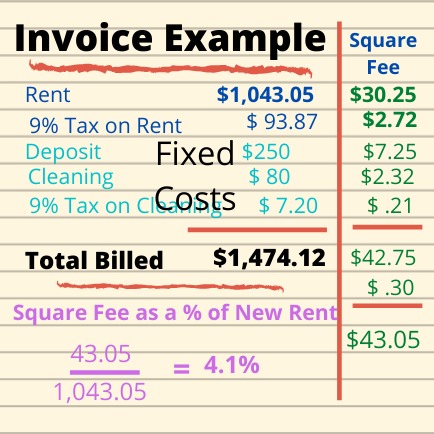

New Rent = $1,043.05

We would have to charge $1,043.05 to our guest to recover $1,000 after Square fees.

Let's Verify

Rent is $1043.05. Tax on rent is $93.87. Our fixed cost including taxes remains at $337.20 for a total invoice to out guest in the amount of $1,474.12. The Square fee is .029 * $1,474.12 + .30 = $43.05.

Subtracting the new Square fee of $43.05 from the new rent of $1,043.05, we get $1,000.00, our intended take-rate for rent.

This fee is 4.1% of your new rental rate ($43.05/$1,043.05) and 4.3% of your desired rental take ($43.05/$1,000).

Let's Calculate Rent When You Want $1,500 Income

Using the same fixed fees as in our earlier example, the total including related 9% tax is still $337.20. If our goal is to take in $1,500, then our the desired amount from the guest is:

1.09 * $1,500 + 337.20 = $1,972.20

Let's figure out New Rent to charge in order to recover $1,972.20 + the additional new tax over the first $1,500 in rent.

New taxable rent + fixed costs - Square Fee = Value Invoiced Before Square Fee + New Additional Tax on Rent

1.09(New Rent) + 337.20 - [ .029 ( 1.09(New Rent) + 337.20 ) + .30 ] = $1,972.20 + .09 (New Rent - $1,500)

1.09(New Rent) - .03161(New Rent) + 327.12 = $1,972.20 - $135 + .09 (New Rent)

.96839(New Rent) = $1,510.08

New Rent = $1,559.37

Let's Verify

New Rent plus 9% tax is $1,699.71. Fixed costs are still $337.20 for a total invoice of $2,036.91. The Square Fee on this amount is $59.37. Subtracting the Square Fee from the new rent, we receive $1,500.

In this example, the Square Fee as a fraction of the new rent is 3.8% ($59.37/$1,559.37). As a fraction of our intended rental income of $1,500, the Square Fee is 4.0% ($59.37/$1,500).

How Can You Calculate The Upcharge?

- Determine the amount you would collect if there was no credit card fee. This invoice would include your desired rental income, all taxes and any fees you charge. This is the base amount you need to still receive. This base amount includes the tax on your intended rent.

- Build your mathematical formula to solve for new rent. The formula needs to subtract the Square fee from the proceeds and acknowledge the additional tax created by the higher rent. The formula would look like this:

New Rent + Tax on New Rent + Other Fixed costs including tax - Square Fee on these 3 items = Value from Step 1 + Additional Tax Required on this New Rent which isn't included in the value in Step 1.

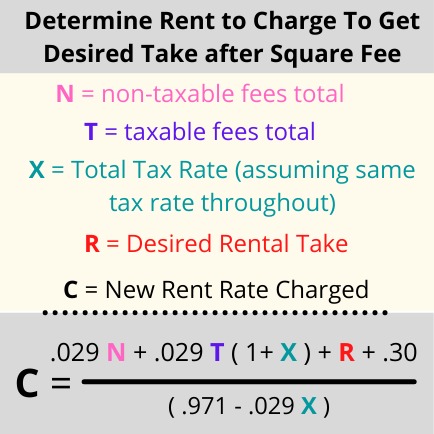

Plug 'n Play Formula

Assuming that there is a single tax rate that applies to all taxable items, just plug in your desired rental take into this formula along with the total non-taxable items, the total taxable items and the tax rate (ex. 9% is written as .09 in the formula) to determine the rate you need to charge to recover your Square fees. This formula assumes just one invoice.

Suggestions on Recovering Credit Card Fees

Rather than accept the Square fee as an expense and reduce your overall income, you might want to charge the guest to recover fees associated with credit card processing. Know that it is illegal in some places to charge a fee explicitly for recovery of this cost. You can increase your rental rate to ensure your income covers this cost. After making these rental fee adjustments, you could offer cash discounts (if allowed in your jurisdiction) ensuring that your net take is the same regardless of payment method.

Personally, I get a little disgruntled when I get an invoice that includes a fee designated as related to my payment by credit card. I would rather that cost be buried in the price of whatever it is I'm purchasing. For that reason and based on these examples where we assume that most reservations are for the $1000 rental fee and a single invoice, I would suggest increasing the rental fee by at least 4.3%. So instead of $1000 rental fee or the $1,043.05 calculated to return $1,000 income, charge the guest $1,050. If most reservations are in the $1,500 range, I would increase the rental fee by 4.0%. Please remember that my examples incorporated a specific tax rate and specific fees that influenced this percentage increase required.

For check payments, you can offer your guest a discount on your new rental rate and still make the rent you intended. However, I would save that offer for repeat guests who are more likely to pay by check since they are familiar with you and your business.

A Note about Refundable Security Deposit and Square

If you issue a refund of the security deposit within 1 year (for invoiced payments and those made using Square integration), Square will also reimburse you the 2.9% credit card fee along with the 30 cents if that invoice was solely for the credit card fee. In my calculations above, I included the security deposit fee as a cost I want to recover. I would suggest keeping the security deposit in the calculation rather than assume the deposit fee will be reimbursed in the future. Square could change its policy or you may be miss the reimbursement window and have to refund the deposit by personal check instead of through Square.

This Houfy website uses cookies and similar tools to improve the functionality and performance of this site and Houfy services, to understand how you use Houfy services, and to provide you with tailored ads and other recommendations. Third parties may also place cookies through this website for advertising, tracking, and analytics purposes. These cookies enable us and third parties to track your Internet navigation behavior on our website and potentially off of our website. By continuing your use of this website, you consent to this use of cookies and similar technologies. Read our Cookie Policy for more information or go to Cookie Preferences to manage settings.

These cookies are necessary for the website to function and can't be switched off in our systems. They are usually only set in response to actions you have taken which result in a request for services, such as setting your privacy preferences, logging in or filling in forms. You can set your browser to block or alert you about these cookies, but some parts of the site may not work as a result.

These cookies are necessary for the website to function and can't be switched off in our systems. They are usually only set in response to actions you have taken which result in a request for services, such as setting your privacy preferences, logging in or filling in forms. You can set your browser to block or alert you about these cookies, but some parts of the site may not work as a result.

These cookies are set through our site by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant ads on other sites. They work by uniquely identifying your browser and device. If you don't allow these cookies, you will not experience our targeted advertising across different websites as a result of these cookies.